They also need to have a problem solving mindset that helps them figure out the underlying causes behind these errors.Īccountants must also go further to take a higher-level strategic view of the business to offer financial planning advice. This allows them to spot and verify any inconsistencies in a business’ financial reporting. Skills neededīoth bookkeepers and accountants need to pay close attention to detail and be able to make fast and accurate mathematical calculations. Many businesses specifically seek to hire CPAs to file their company’s tax returns. Passing the CPA exam and joining the American Institute of Certified Public Accountants allows accountants to do more things, such as represent people and companies before the IRS and act as external auditors.

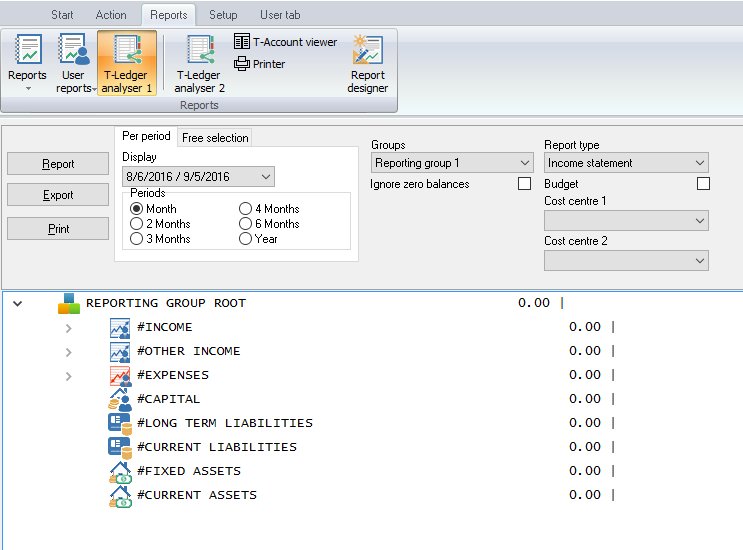

#Bookkeeping software windows 7 professional#

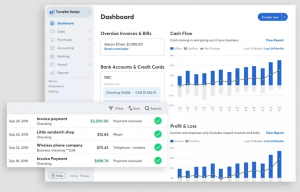

They also need hands-on experience through internships and other professional opportunities.Īccountants don’t have to sit for the Certified Public Accountant (CPA) exam, but many choose to do so. Since most bachelor’s degrees only provide 120 hours of course credit, many accountants complete a master’s degree as well. Some bookkeepers choose to earn an optional certification from associations such as National Association of Certified Public Bookkeepers or the American Institute of Professional Bookkeepers.Īccountants must have at least a bachelor’s degree and most have logged at least 150 credit hours of accounting and business courses. The 8 Best International Payroll Services for 2023Ĭhoosing a payroll service: A guide for business leaders The Best Payroll Software for Enterprises in 2023 Others are self-taught and learn bookkeeping simply through using QuickBooks or other accounting software. There is no formal education degree or certification requirements for bookkeepers, though many bookkeepers have taken some sort of class or training on the subject. Most bookkeepers have a high school degree or GED. Reviewing and analyzing financial statements. To contrast bookkeeping and accounting, we’ve outlined the main differences in the chart below. accounting: Key differences Typical responsibilitiesĪt first glance, accounting and bookkeeping may seem very similar, but they each encompass different activities. Most accounting software, such as the every popular QuickBooks (Figure A), includes bookkeeping functionality as part of its software package.įigure A QuickBooks makes it simple to track your business’s accounting in one dashboard. SEE: Best Accounting Software for Small Businesses in 2023Īll bookkeeping activities fall under accounting, but not all accounting activities are bookkeeping - businesses need both accounting and bookkeeping to stay financially healthy. What is accounting?Īccounting is a broader activity that encompasses recording a company financial transaction through bookkeeping as well as other tasks such as preparing tax returns and offering financial planning advice. There are several different ways to record bookkeeping, such as writing it by hand in a notebook, typing it into an Excel spreadsheet, and inputting the data into bookkeeping software. Bookkeeping captures all money flowing into and out of a business, including bills, receipts, invoices, purchase orders and vendor payments.

By the end, you should be able to decide whether your business needs to hire a bookkeeper, accountant or both. In this guide, we’ll explain what bookkeeping is, what accounting is and the key differences between them. Both bookkeeping and accounting are essential for maintaining the financial health of your company. While you may have heard other people use these terms interchangeably, bookkeeping and accounting are actually two separate (but closely related) business activities.

If you’re a business owner, understanding the differences between bookkeeping and accounting can be confusing. Learn the differences between bookkeeping and accounting, including their respective roles and responsibilities. Accounting: What Are the Key Differences?

0 kommentar(er)

0 kommentar(er)